Presented by Meyers Nave, this edition of San Diego’s Data Bites covers November 2021, with data on employment and more insights about the region’s economy at this moment in time. Check out EDC’s Research Bureau for even more data and stats about San Diego.

KEY TAKEAWAYS

- San Diego establishments added 15,000 jobs to the region’s economy in November, bringing total nonfarm employment to 1,469,800. Meanwhile, the unemployment rate dropped to 4.6 percent from a revised 5.3 percent in October. Although total employment is still 45,400 lower than pre-pandemic levels, job growth is trending in the right direction.

- Retail Trade showed the largest employment gains in November with 5,400 payroll positions added, which is unsurprising as local retailers prepared for the holiday season. In fact, according to Affinity Solutions, consumer spending in San Diego during November was about 20 percent greater than January 2020.

- Housing affordability is a perennial issue for San Diego. Even taking geographic variation into consideration, all but one ZIP code in San Diego is unaffordable when comparing median income to average mortgage payments. High cost of living in San Diego could push away the talent that businesses need to compete both domestically and internationally.

Employment gains continue across industries

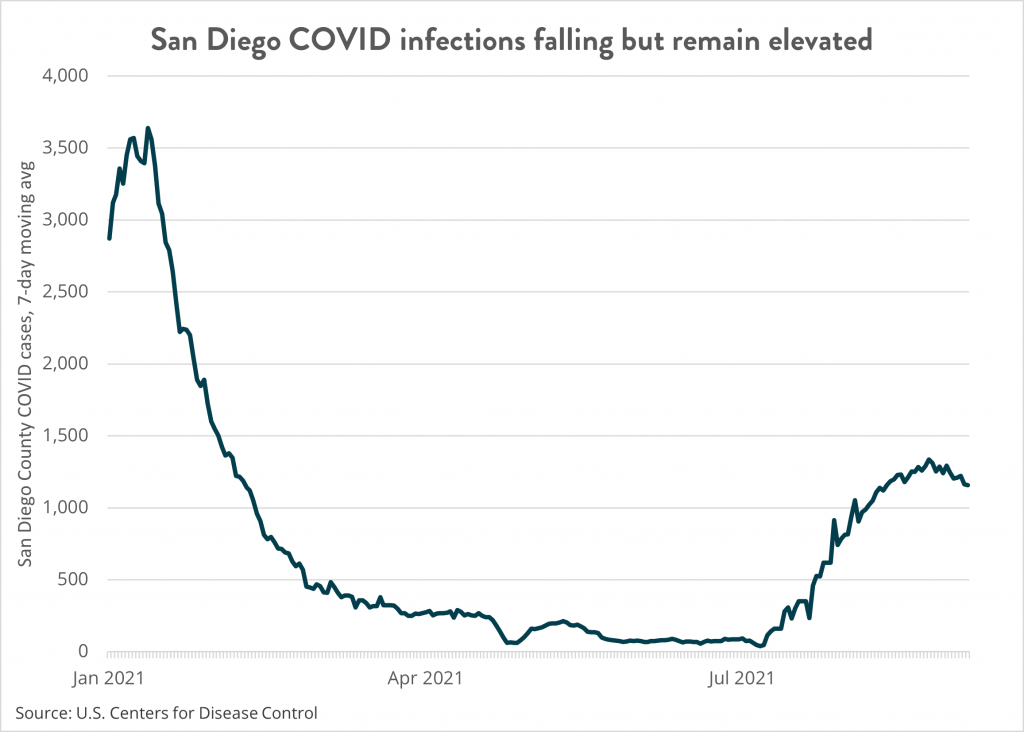

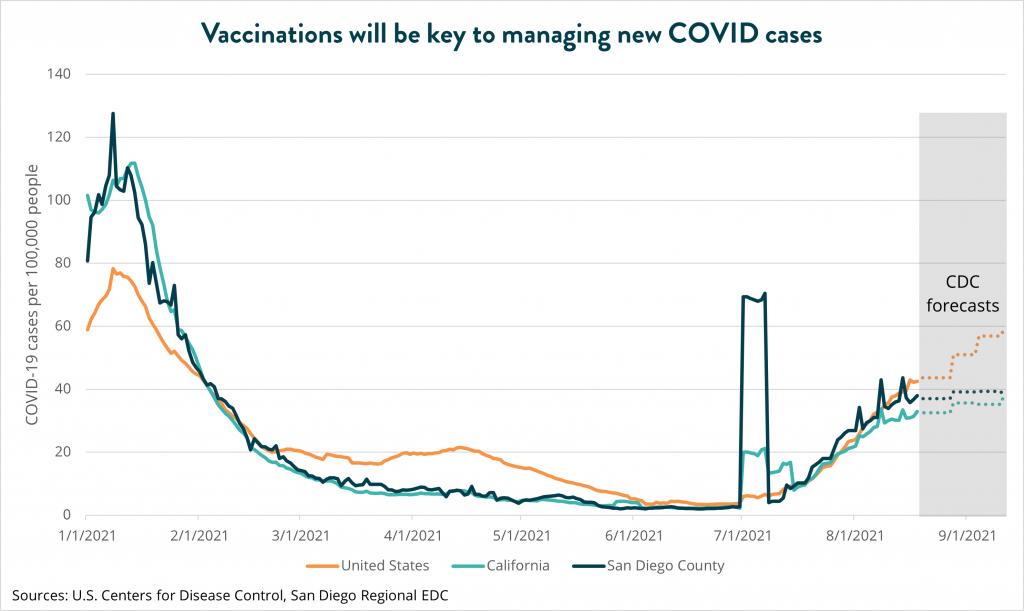

Following October’s impressive employment gain–revised to 29,100 jobs added– employers in San Diego added 15,000 payroll positions, most of which is from hiring for the holiday season. Employment in Retail Trade increased by 5,400 and was fairly consistent throughout subsectors. Despite brick-and-mortar establishments remaining open, novel variants of the COVID-19 virus remain a concern, creating hesitancy to return to work or shop in-person.

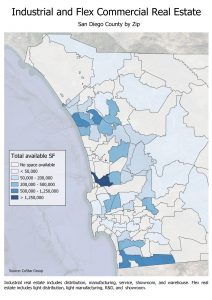

As such, e-commerce and online retail are expected to have record years, reflected in part by employment gains in Transportation and Warehousing of 2,200 jobs. Since more consumers are shopping online this holiday season than in previous years, online retailers are employing more workers in fulfillment centers and warehouses. In fact, Amazon is further expanding its footprint in the region, with a new warehouse and jobs in Otay Mesa.

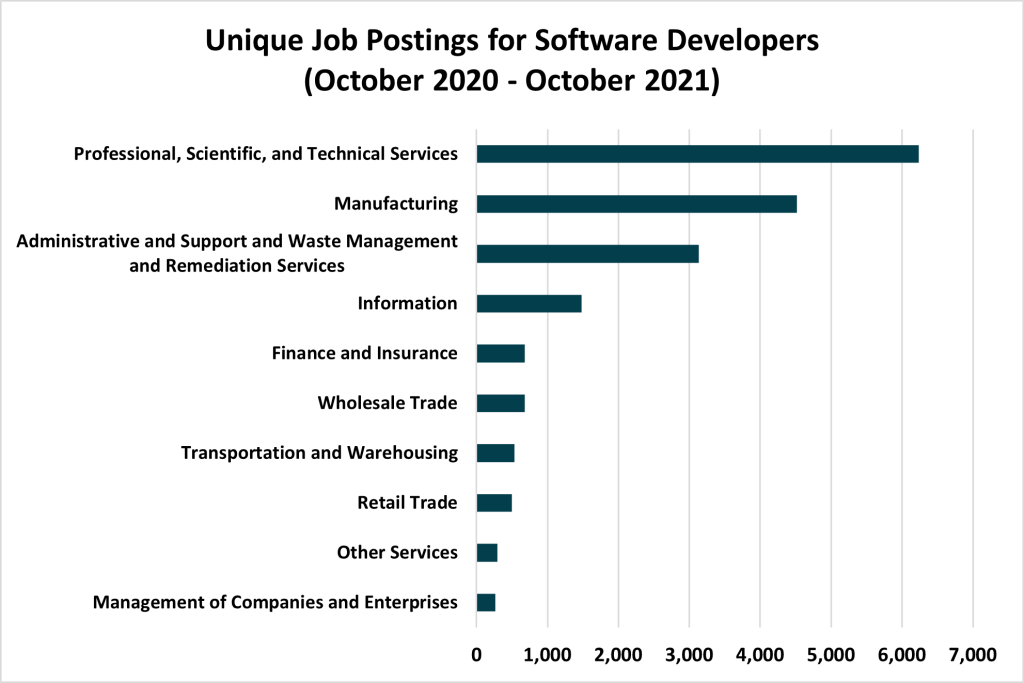

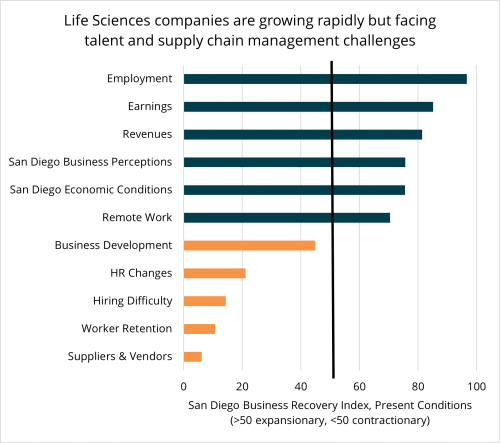

Although these employment gains are often seasonal, San Diego’s thriving Life Sciences cluster is driving growth of quality jobs in Professional and Business Services, with Scientific Research and Development Services adding 700 jobs in November. These jobs are not only high-paying, but the ripple effects through the rest of the economy are significant, as every job in Scientific Research and Development Services supports two jobs elsewhere in the economy through indirect and induced effects.

Affordability remains a challenge

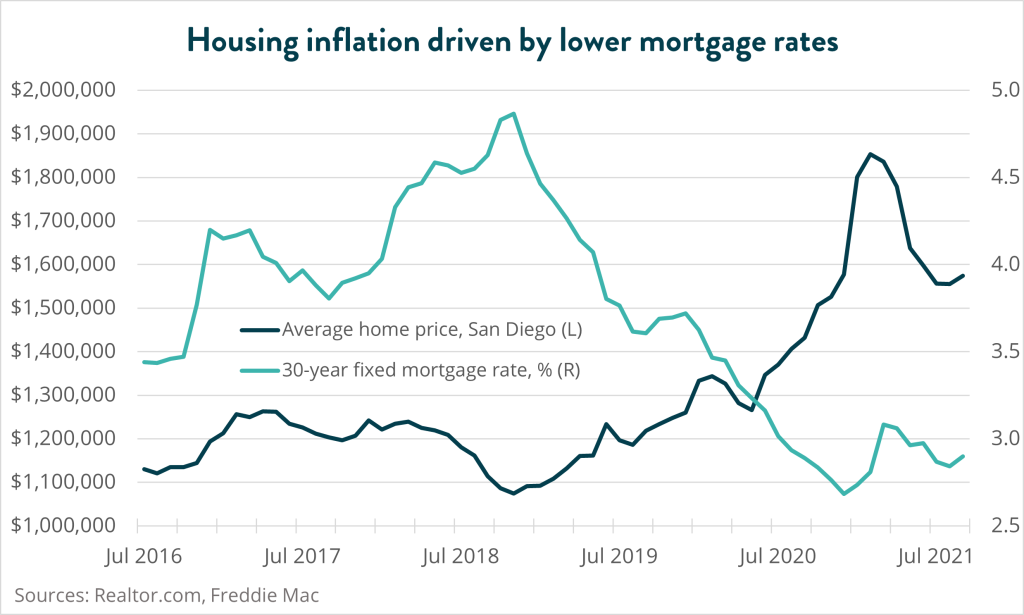

It is no secret that coastal regions are some of the most expensive places in the world to buy a home, and San Diego is no exception. Although the housing affordability crisis was present before COVID, the pandemic has had profound effects on the housing market. Home sales in San Diego skyrocketed across 2020 and 2021, taking home prices along for the ride to record highs. Although the determinants of this activity are many, the Great Reshuffling of workers played a large role in what the housing market has experienced over the past two years. The relocation of workers has many facets, but two stand out: workers being forced to move to a more affordable region due to being laid off; and the adoption of remote work by many employers.

As some workers were forced out of San Diego in search of employment and more affordable housing, others fortunate enough to keep their jobs in a remote work environment were afforded the opportunity to move into the region. Anecdotal evidence abounds of homes being sold in the snap of a finger, in cash, and above listing price. Over the course of the pandemic, the ratio of median home sales price to median home list price was greater than one in many ZIP codes in San Diego. This means that demand for homes was so great over the pandemic that competitive offers for purchasing a home needed to come in above the listing price.

While the sale-to-list ratio sheds light on activity in the housing market, affordability is captured by the ratio of median household income to average mortgage payments, with higher numbers implying better affordability. Generally speaking, mortgage payments should comprise about 30 percent of household income–an income to payment ratio of 3.3; any more than that is considered housing cost burdened. We calculated the average monthly mortgage payment for the median priced home in ZIP codes across San Diego, using mortgage rates provided by FRED and assuming zero percent down. Comparing the median household income in each ZIP code to these average mortgage payments gives an indication of the level of affordability in a given geographic area.

True to the trend, coastal communities in San Diego are the least affordable, with many ZIP codes showing an income to payment ratio below 1. In fact, there is not a single coastal community that exhibits an income to payment ratio above 1.4. This means that if the median income household purchased a home at the median price for that particular ZIP code, approximately 71 percent of their monthly income would be allocated toward their mortgage payment.

As can be seen in the interactive map above, the further away from the coast, the more affordable housing is relative to the coastal communities. However, this does not simply imply that housing is affordable in absolute terms. Taking an income to payment ratio of 3.3 as the threshold of housing cost burdened, only one zip code in San Diego qualifies as affordable: Palomar Mountain, 92060.

San Diego is an unaffordable market for a majority of home buyers, especially first-time home buyers who were born and raised here. The most pressing problem is the slow pace of new construction permits, which are not keeping up with population growth and housing demand in San Diego. As San Diego becomes a more expensive place to live, talent is steered away from the region. Developing, recruiting, and retaining this talent is pivotal for the success of regional businesses, both large and small.