THE TAKEAWAYS

- Fresh thinking on career advancement is needed in order to create a more resilient San Diego economy.

- San Diego’s lowest-paid workers were the first to be let go during the COVID downturn and will likely be the last to be called back to work.

- Upskilling and reskilling employees in lower-paying sectors like retail and leisure and hospitality will improve living standards and help businesses in other industries find qualified talent without draining the pool of workers for retailers, restaurants, and bars.

- Colleges and universities will need to rethink curricular requirements in order to adapt to the changing needs of the business community.

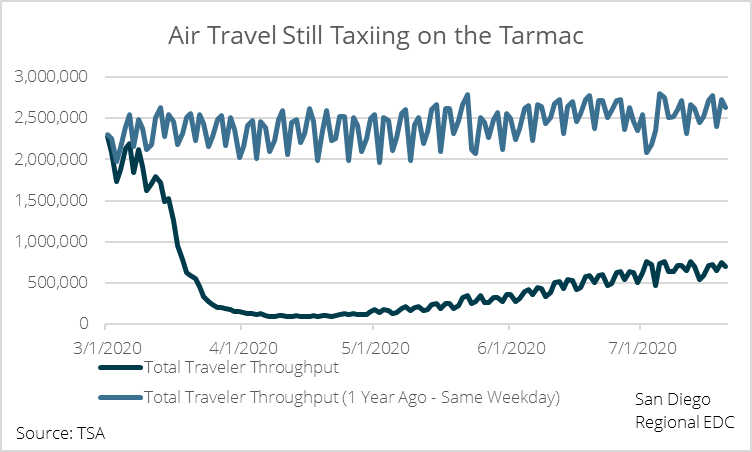

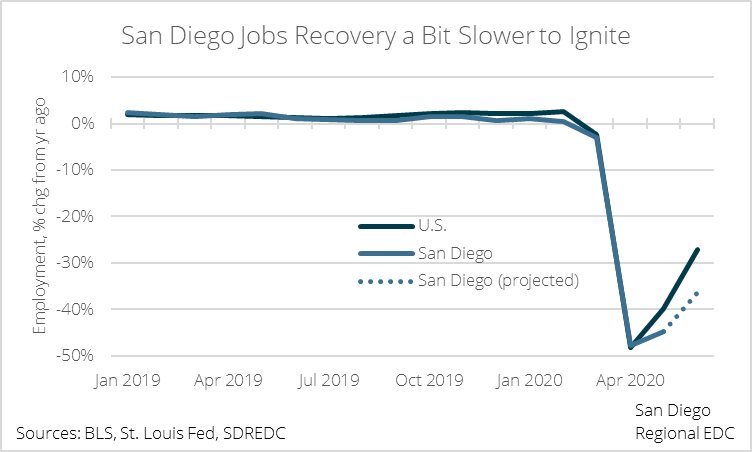

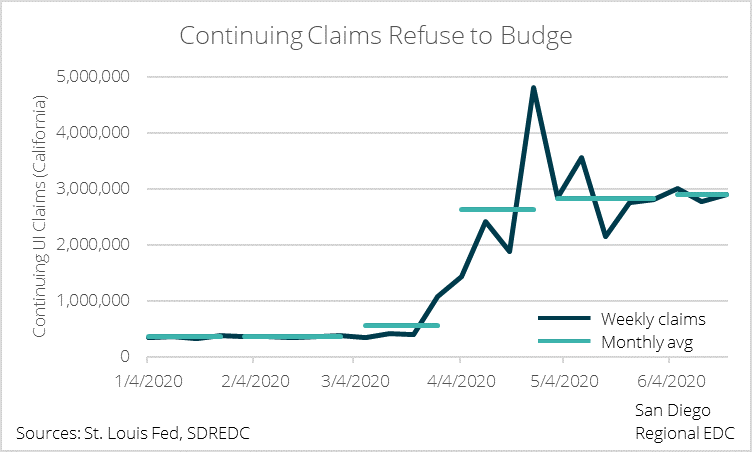

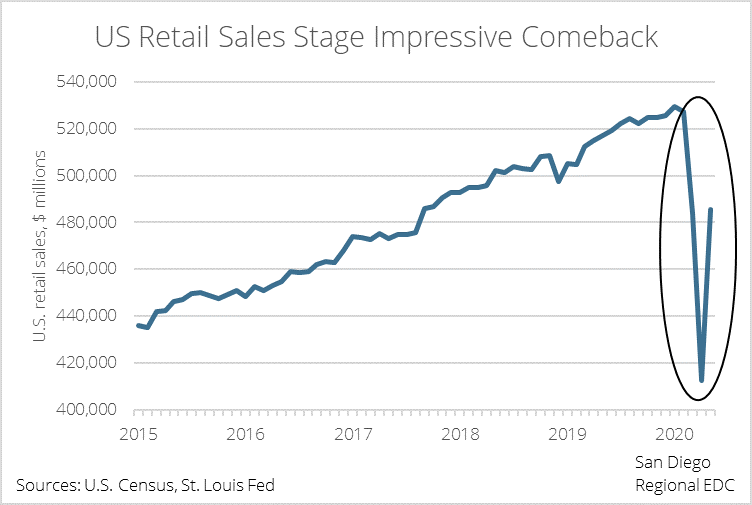

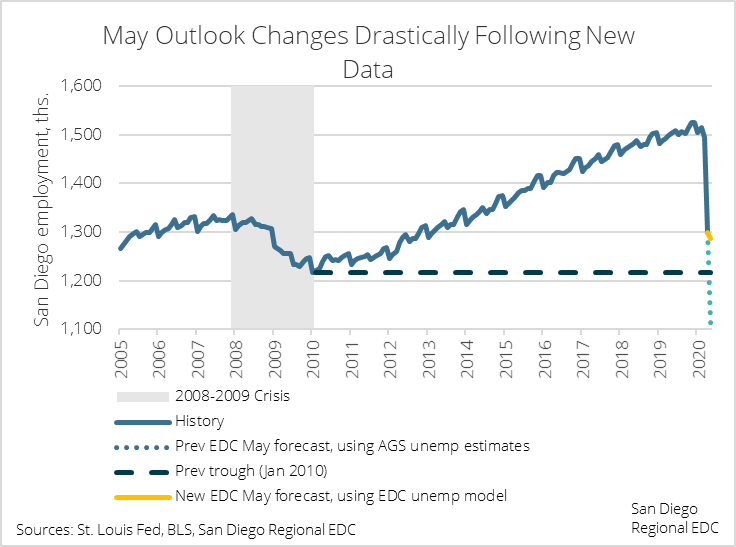

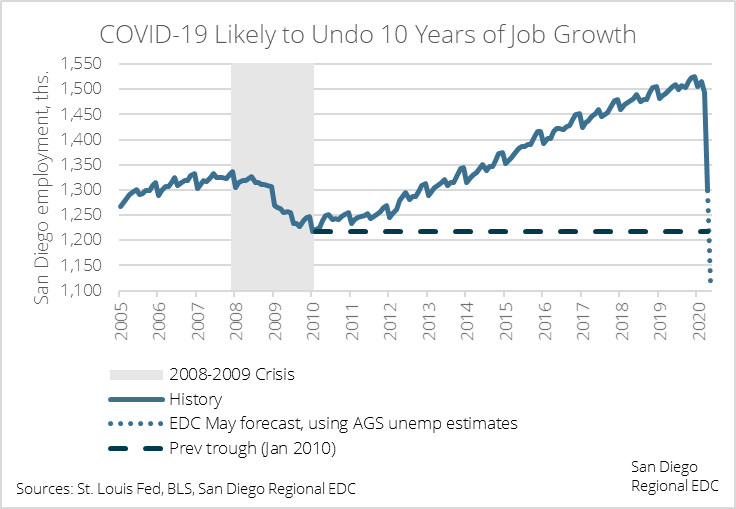

San Diego’s economy has emerged from the depths of the COVID downturn, but the road to a full recovery is looking longer (and bumpier) than many expected. A second wave of business shutdowns and restrictions amid a rise in positive cases last month portends a significant weakening in the outlook heading into late summer and fall.

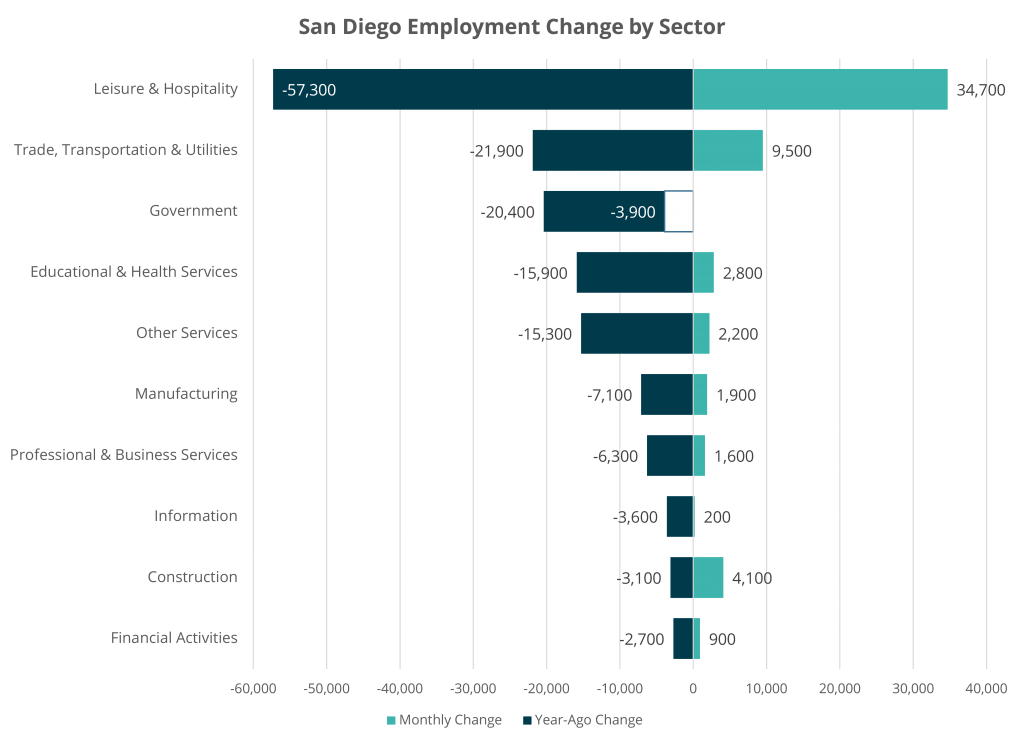

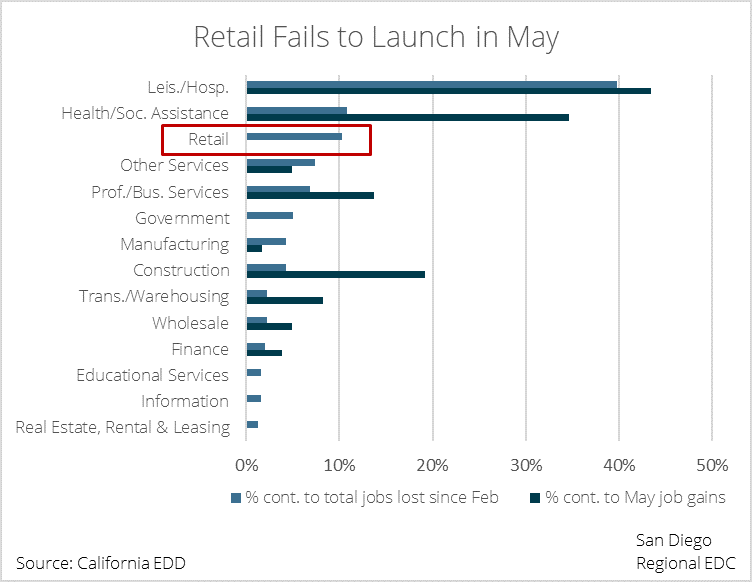

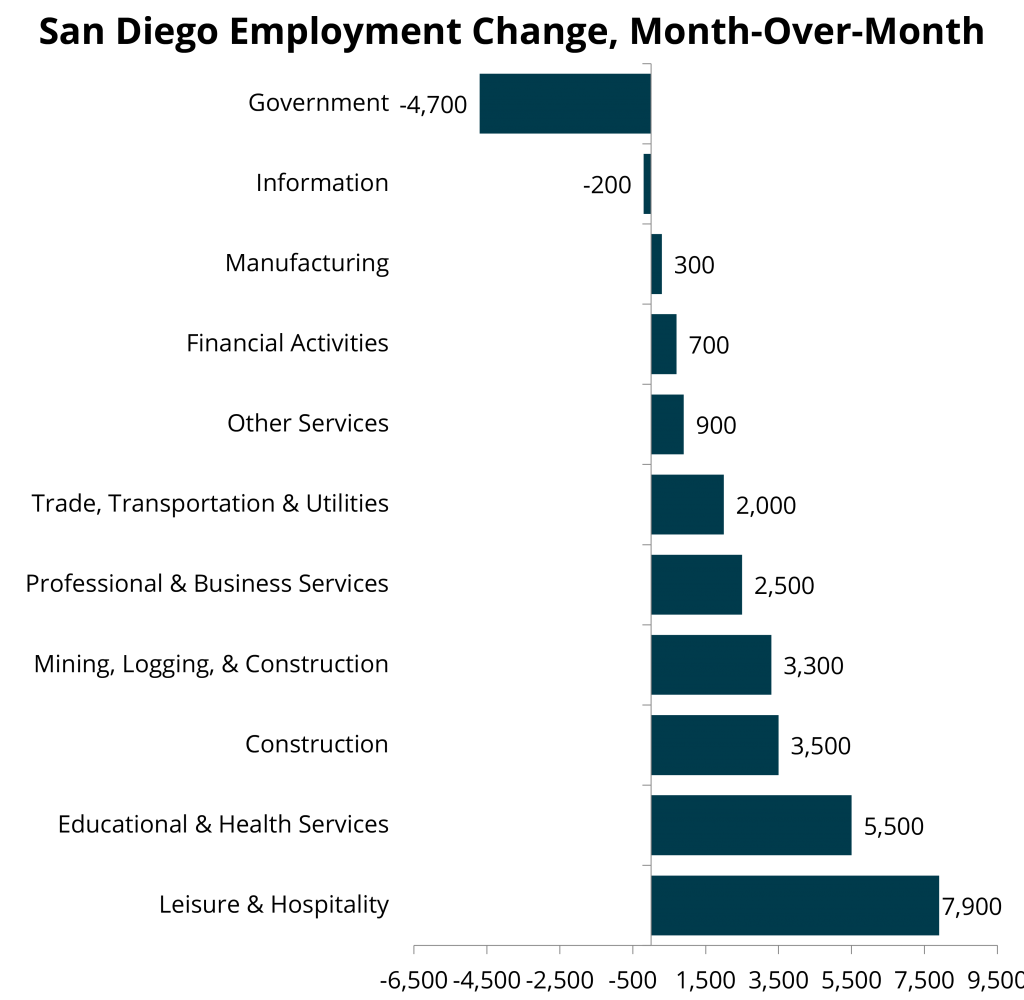

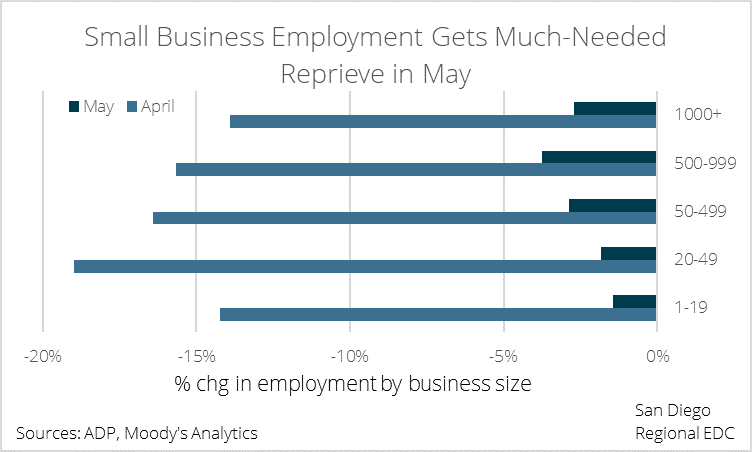

The unexpected and historically severe drag on San Diego’s job market since March underscores the need to build a more resilient workforce that can better weather future downturns. More than half of the 223,700 jobs shed between February and April were in leisure and hospitality and retail alone. These jobs could be slow to come back, since shops, restaurants, bars, and venues won’t be able to operate at full capacity until an effective and safe vaccine has been widely produced and distributed—something that’s not expected until at least early next year.

THE MOST VULNERABLE HAVE BECOME THE MOST VULNERABLE…AGAIN

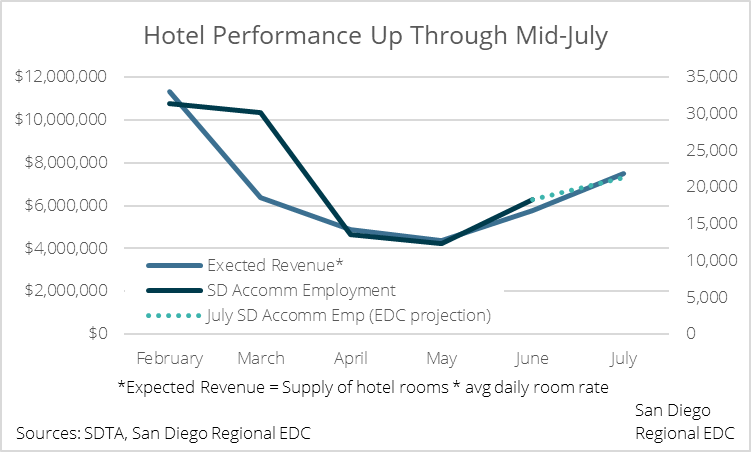

Other sectors have undoubtedly been rocked by the economic shockwave of the COVID pandemic, but retail and leisure and hospitality workers were especially susceptible, particularly those in accommodation and food services. Not only were they the first to be let go, but many will likely the last to be rehired. What’s worse, San Diego’s accommodation and food service employees made just over $30,000, on average, last year compared to about $74,000 for all workers.

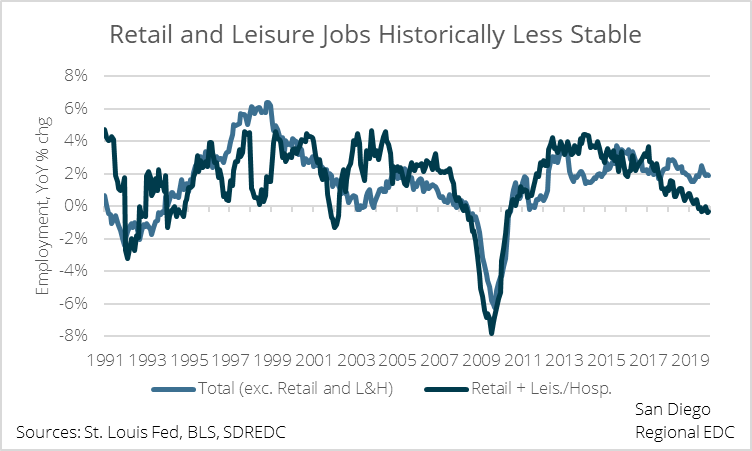

The outsize damage to leisure and retail is not isolated to just the past few months. Both industries have historically been more volatile over the past few decades. During the Great Recession of 2007-2009, total nonfarm employment in San Diego fell 8.9%. However, retail employment tumbled 16.2% and leisure and hospitality gave up 14.1%. It stands to reason that a similar dynamic could play out when the next downturn inevitably arrives.

TAPPING INTO NEW TALENT

Tourism, which includes retailers, accommodation, and eating and drinking establishments, is a large and important piece of the economic pie (pun intended) here in San Diego. Luckily, tourism-related industries have a huge supply of readily available workers. Upskilling and reskilling of many of the employees looking to get out of hospitality could expand the base of workers in relatively higher-paying, less volatile occupations without draining the pool of qualified workers for local restaurants, bars, and hotels. This could be extended to retail and other lower-paying sectors and would simultaneously improve living standards while alleviating stress on local employers who can’t find qualified talent in non-tourism fields. It would likely keep a greater number of people employed during future downturns, too.

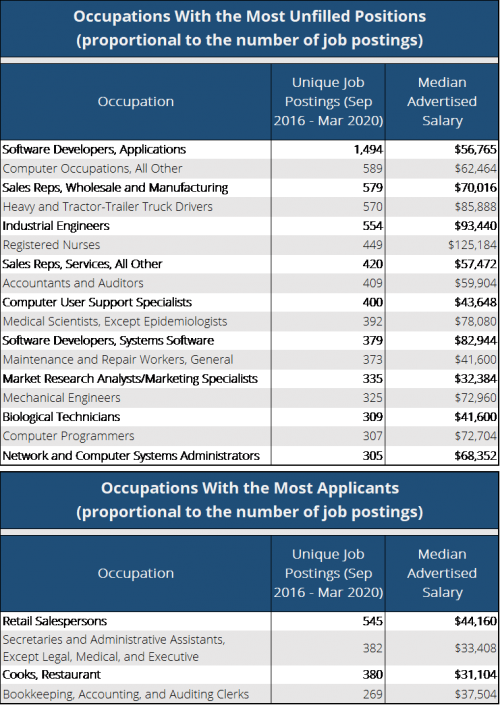

Looking at job postings data for the region, local employers have had a tough time filling roles in a wide variety of occupations. Software developer and engineering roles are ubiquitous on lists like these, but it extends well beyond the buzzy positions du jour and includes others like marketing managers, sales reps, and truck drivers. The average annual pay for these and other in-demand positions is over $63,000 per year versus $36,720 for jobs where more than enough applicants can apply.

SO, WHAT’S THE CATCH?

As usual, the devil’s in the details. Even after things begin to normalize, walking out on one’s barista job to immediately pursue a post-secondary degree in electrical engineering typically isn’t an option. Consequently, career advancement would have to occur more gradually and require some serious curricular agility from local colleges and universities.

EDC’s Advancing San Diego initiative is exploring a viable path forward. The initiative serves to boost lower-paid employees into more stable, higher paying jobs with greater potential for upward mobility, called “lifeboat jobs.” An example would be someone like a forklift operator at a local factory who could ultimately climb the rungs into Operations Management.

With better connectivity to academia, business leaders can begin to communicate the specific skills required to successfully perform lifeboat jobs in any number of high-demand positions. Then, local colleges and universities could build out “micro-credential” certificates or academic programs designed to prepare workers in a matter of weeks—rather than years—to take on those jobs.

Given the deeply-seeded roots of tradition in academia, this would likely emerge most immediately as a strategy in the universe of Continuing or Extended Studies. However, the swiftly evolving landscape of business in the 21st century seems to suggest that a more targeted and flexible approach to general coursework would provide the best value for students (and parents) and would also be of great service to businesses looking for a reliable pipeline of skilled workers upon graduation.

For more COVID-19 recovery resources and information, please visit this page.

EDC is here to help. You can use the button below to request our assistance with finding information, applying to relief programs, and more.

You also might like: