On January 15, San Diego Regional EDC, in partnership with Bank of America, hosted a dynamic luncheon to explore the healthcare talent landscape in San Diego County. This event brought together a cross-section of 75+ healthcare industry leaders, educational institutions, nonprofits, and community advocates to spotlight the region’s healthcare workforce challenges and opportunities. Together, we launched a critical conversation about how collaboration and an industry-led approach can strengthen our regional healthcare talent pipelines.

Advancing San Diego: A look at the state of healthcare in the region

“I think everyone in this room can agree that a strong healthcare system is important for our region to thrive,” said Pamela Gabriel, senior vice president for Bank of America, San Diego.

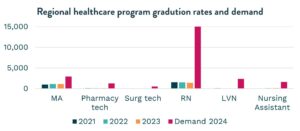

San Diego’s healthcare sector is one of the fastest-growing industries, essential for a thriving economy. However, the gap between education and workforce needs presents a challenge. During the luncheon, Bridgette Coleman, program manager for Advancing San Diego at EDC, shared compelling data that underscored the urgency of addressing these issues:

- Registered Nurses (RNs): More than 15,000 unique job postings were recorded between December 2023 and November 2024, in San Diego. Yet, fewer than 2,000 program completions were achieved annually, creating a severe supply-demand mismatch.

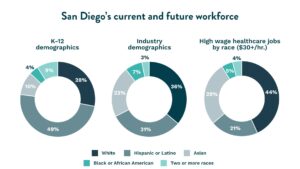

- Demographics: The healthcare workforce demographics do not reflect the diversity of San Diego’s population, emphasizing the need for inclusive access to training and career pathways, especially into high-wage roles like RNs. Better diversity in lower-wage roles such as Medical Assistants (MAs) and Licensed Vocational Nurses (LVNs) indicate that a focus on these feeder roles might be an impactful way to support the RN talent pipeline.

- Clinical hours bottleneck: Limited opportunities for nursing students to complete clinical hours exacerbate the talent pipeline challenges, delaying the transition from education to employment.

Review the full Advancing San Diego Healthcare Employer Working Group slide deck for more information about the current state of healthcare in San Diego County.

Addressing the talent gap with strategic programs and partnerships

The luncheon featured a panel of leaders with successful initiatives to bridge the talent gap and fostering inclusive growth:

- Cal State San Marcos highlighted its interdisciplinary mobile clinic, which provides healthcare services to underserved communities while envisioning its expansion as a potential clinical hour completion site for students.

- Scripps Health showcased its innovative employee training and retention programs, which boast only a 3 percent vacancy in nursing positions, emphasizing commitment to collaborative regional leadership in addressing healthcare workforce challenges.

- San Diego State University (SDSU)–Imperial Valley discussed its targeted nursing programs designed to increase access for Imperial Valley College students to access education and training at SDSU for nursing careers and identify new opportunities for clinical placements.

- San Diego and Imperial Counties Community College Consortium focused on how its improving access through standardized processes, career pathway research, outreach to underrepresented groups, and expanding advanced nursing degree transfer programs.

These initiatives exemplify the power of partnerships in addressing workforce challenges and ensuring that all San Diegans have access to career opportunities in this vital industry.

Join us in building stronger talent pipelines

EDC’s Talent Pipeline Management (TPM)© framework is a critical tool in addressing these gaps. By fostering stronger collaboration between employers and educational institutions, we can create scalable, employer-driven solutions that meet the region’s healthcare needs.

The healthcare talent needs in San Diego demand a unified, proactive approach. EDC’s Advancing San Diego program invites industry partners to join our Employer Working Group in leveraging the TPM to address these challenges. This employer-led strategy provides real-time insights, enabling us to:

- Evaluate pain points and opportunities directly from the employers’ perspectives.

- Build tailored solutions that address immediate and long-term workforce needs, while measuring return on investment of these solutions.

- Grow skilled talent in San Diego by connecting underserved populations to training and career pathways, aligning with the region’s Inclusive Growth framework.

By working together, we can ensure a robust healthcare workforce that meets the needs of our region while driving economic growth and community well-being.

Take action

Ready to get involved? We are looking for healthcare employers to join our mission to strengthen San Diego’s healthcare talent pipeline. Learn more and connect with us:

- Complete the healthcare Employer Working Group interest form

- Read the regional healthcare report

- Host summer interns at no cost

Plus, contact our team today:

Taylor Dunne

Director, Talent Initiatives