Presented by Meyers Nave, this edition of San Diego’s Data Bites covers January and February 2022, as well as an additional update on annual benchmark revisions, with data on employment and more insights about the region’s economy at this moment in time. Check out EDC’s Research Bureau for even more data and stats about San Diego.

KEY TAKEAWAYS

- San Diego’s unemployment rate dropped by 0.7 percentage points–from a revised 4.7 percent in January to 4 percent in February–with nonfarm employment increasing by 16,500 payroll positions.

- Employers in the region added more than 104,000 payroll positions since February 2021–with Service Providing industries accounting for 102,600 of the added jobs–lowering the unemployment rate by 3.7 percentage points.

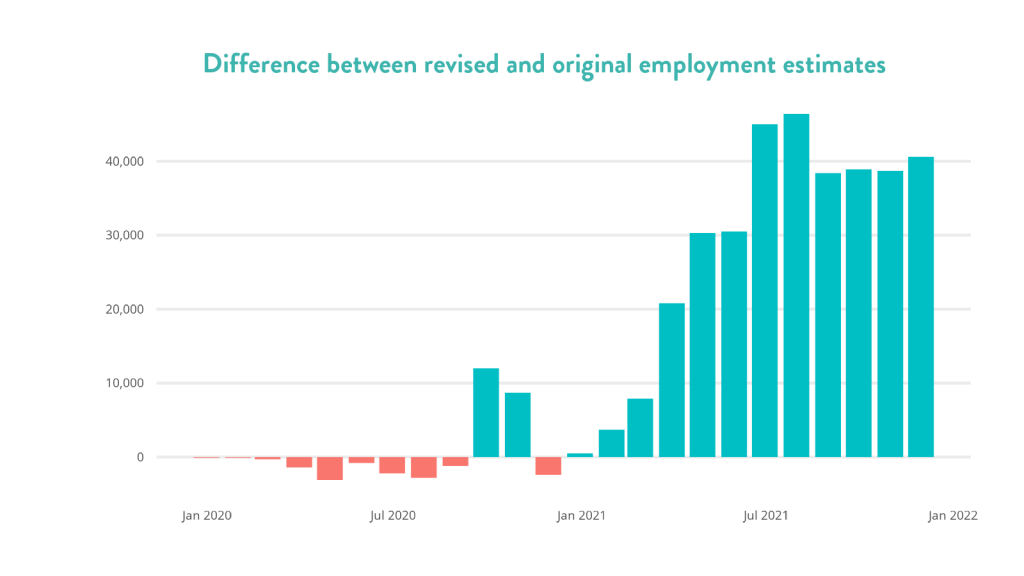

- Annual benchmark revisions to employment data show that the region’s economy was recovering more rapidly than initially believed. Specifically, revisions to nonfarm employment for December 2021 improved the jobs count by more than 40,000 workers.

Service Providing industries lead month-ago and year-ago changes

February’s jobs report painted a positive picture for the San Diego regional economy. With respect to changes from January to February, nonfarm employment increased by 16,500, driving the unemployment rate lower to 4 percent from a revised 4.7 percent in January. Service Providing industries led the pack in employment gains, as Professional and Business Services added 6,100 jobs, Educational and Health Services added 4,800 jobs, and Leisure and Hospitality added 4,200 jobs. Trade, Transportation, and Utilities dropped 2,700 jobs, however, with employers in Retail Trade shedding 2,300 payroll positions. Manufacturing industries also had a down month, with losses of 1,000 jobs in Durable Goods production.

Service Providing industries were also the leaders in year-ago employment gains from February 2021, adding more than 104,000 jobs to the region. The slow and steady employment gains over the last year have resulted in the unemployment rate dropping by almost four percentage points from a revised 7.9 percent in February 2021 to 4 percent in February 2022. Within the Service Providing sector, Leisure and Hospitality added 52,700 positions, which is a good sign of recovery as these companies were the hardest hit during the pandemic. Employers in Professional and Business services also added 21,100 payroll positions, 9,300 of which were in Professional, Scientific, and Technical Services. These gains were not felt across all industries, however, as Durable Goods manufacturing lost 1,900 jobs from February 2021.

February employment inches closer to pre-pandemic levels

Looking at changes from February 2020 to February 2022 shows that the region is getting ever closer to pre-pandemic levels, a good sign for the recovery of San Diego’s economy. Total nonfarm employment is only about 25,000 (1.64 percent) lower than before the pandemic. Over half of these missing jobs are in Leisure and Hospitality, as the industry shows 14,000 fewer jobs in February 2022 than the same month in 2020, a gap of around 7 percent. Durable goods manufacturing is also exhibiting signs of a slower recovery with 6,200 fewer payroll positions than before the pandemic, or about 7 percent lower.

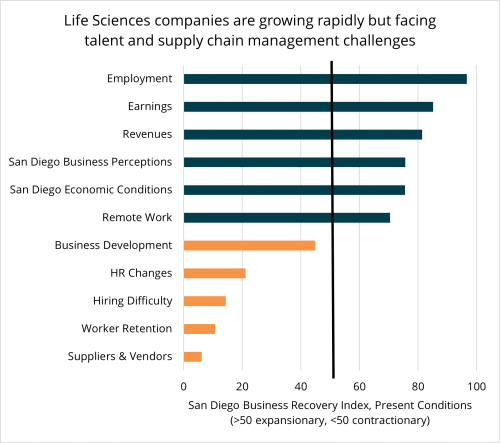

Despite some industries still playing catch-up, many have surpassed pre-pandemic employment levels. Professional and Business Services employers have added 19,300 payroll positions since February 2020, an increase of 7.4 percent. Notably, Administrative and Support and Waste Services have added 11,000 jobs (up 12.4 percent) while Professional, Scientific, and Technical Services have increased employment by 8,900 (up 6.05 percent). Speaking to San Diego’s position as a leader in Innovation and Life Sciences, companies in Scientific Research and Development Services have added 7,300 jobs since the start of the pandemic, an increase of more than 20 percent. With a hiring frenzy in innovation-related industries in full force, it is imperative for our region’s competitiveness that we continue to bolster the supply of the skilled labor that San Diego companies demand.

This means building a strong local talent pipeline of home-grown talent. It also means addressing the region’s affordability crisis so that it remains attractive to both businesses and workers. More at inclusiveSD.org.

Annual revisions show employment was greater during 2021 than first believed

Every March, the California Employment Development Division works with the Bureau of Labor Statistics to revise employment data, a process called benchmarking. Depending on the year and the difficulties in gathering accurate employment data, these revisions might be significant. For reasons that should be unsurprising by now, 2021 was one such year.

What is striking about these revisions is the increasing underestimation of employment throughout 2021. Although January’s revised employment count was only about 500 greater than original estimates, the number had grown to 40,600 by December 2021. Put another way, original estimates were about 3 percent lower than the revised numbers. While this may seem like a trivial distinction, it does indicate that San Diego’s economic recovery was even stronger than originally believed. In fact, the industries that were most impacted by the pandemic reported some of largest upward revisions.

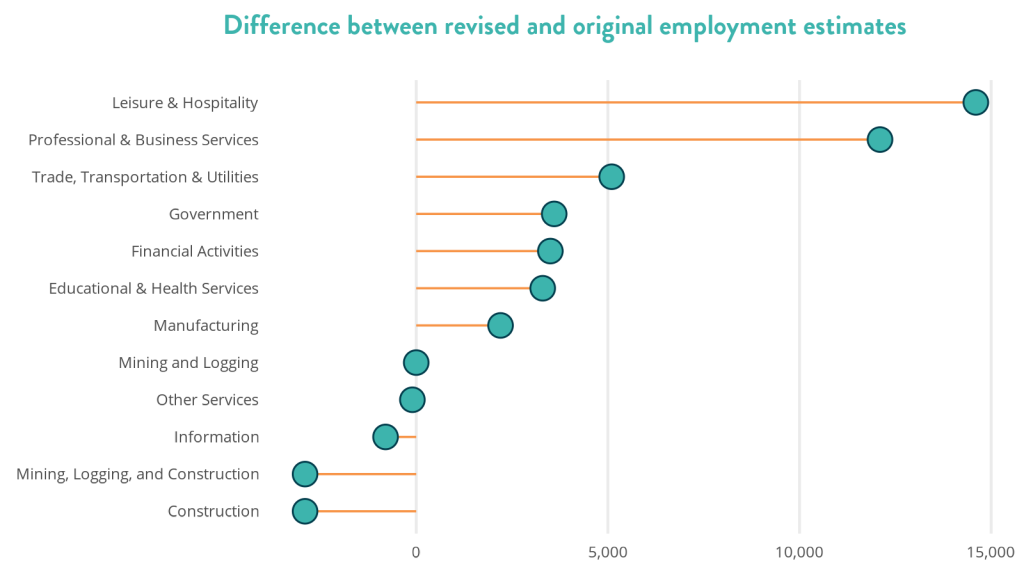

Leisure and Hospitality had 14,600 more jobs in December 2021 with the revised numbers (an upward revision of 8.7 percent), being driven by 8,500 jobs in Accommodation and Food Services (an upward revision of 5.8 percent). Revisions increased the employment count in Professional and Business Services by 12,100 (an upward revision of 4.5 percent), largely attributable to changes in Administrative and Support Services (an upward revision of 7,400, or 8.7 percent). All industries did not show an increase due to the annual revisions, however. Employment in Construction was lowered by 2,900 jobs (a downward revision of 3.4 percent) while the jobs count in Retail Trade was decreased by 2,100 jobs (a downward revision of 1.4 percent).