Presented by Meyers Nave, this edition of San Diego’s Data Bites covers July 2021, with data on employment and more insights about the region’s economy at this moment in time. Check out EDC’s Research Bureau for even more data and stats about San Diego.

KEY TAKEAWAYS

- San Diego lost a net 7,800 payroll jobs in July, but this is largely due to seasonal fluctuations. Public and private educational services employment dropped by 16,200 as teachers and staff break for summer. Barring those losses, payrolls grew by 8,400, led by a build of 6,100 positions at Leisure and Hospitality establishments.

- The unemployment rate ticked lower to 6.9 percent from June’s 7.0 percent even as an additional 16,100 workers joined or rejoined the labor force last month. The labor force has grown by more than 24,000 people since June, further debunking the assertion that workers are sidelining themselves amid extended emergency federal unemployment benefits.

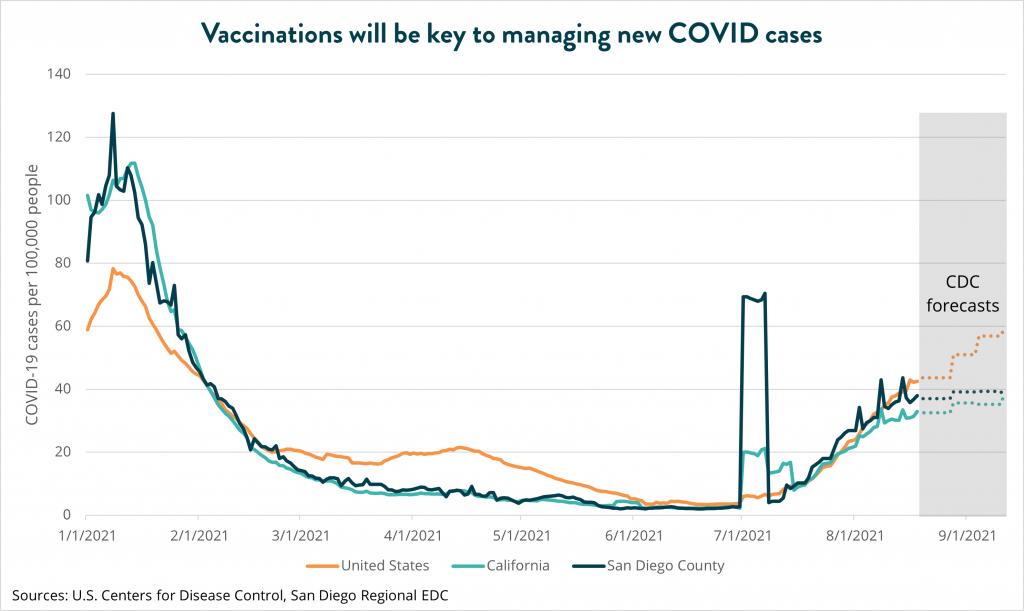

- Recent data on COVID cases have been flashing red, but there’s good reason to believe that San Diego will not suffer as badly as other regions across the country where fewer people have been fully vaccinated. Additionally, the data clearly support the idea that the region’s recovery hinges in large part on how many more San Diegans get the vaccine in the coming weeks.

The data

San Diego establishments shed 7,800 jobs in July, primarily the result of seasonality. The vast majority of job losses came from public and private Educational Services as teachers and staff began summer break and durable goods Manufacturing as factories undergo annual retooling. As such, job losses in July are common and not unexpected, and it’s worth noting that last month’s losses were less severe than in prior years leading up to the pandemic.

Local Government Education (K-12 schools), State Government Education (colleges and universities), and private Educational Services gave up a combined 16,200 positions, leading the region’s losses for the month. Meanwhile, durable goods Manufacturing employment fell by 1,100.

On the bright side, Leisure and Hospitality continued to lead job growth, adding 6,100 jobs in July, followed by an additional 2,800 Construction jobs.

Notwithstanding last month’s minor setback, employment is up 4.5 percent from a year earlier, another positive indication that San Diego is restoring jobs lost during the COVID pandemic. In particular, Accommodation and Food Services employment, which was hit the hardest during the pandemic, has jumped 36.7 percent compared to July 2020.

What about COVID?

Recent headlines have focused largely on the “fourth wave” of COVID-19 infections across the country, as the Delta variant spread through communities and mask mandates and business restrictions were relaxed over the summer. To be sure, the seven-day average for new cases in the U.S. spiked more than tenfold to 140,000 as of August 18 after settling at around just 11,000 to 12,000 new cases per day in the second half of June.

Cases in the San Diego region have also climbed significantly in recent weeks, although the story is more nuanced here. Vaccination has been a key asset to the region: According to the U.S. Centers for Disease Control (CDC), 45.4 percent of all residents in San Diego County are fully vaccinated (have received at least two doses), placing the region in the 75th percentile for all counties in the United States. Vaccination does not provide 100 percent immunity to COVID-19 or its variants, but it does reduce the severity of symptoms, including the possibility of death. In fact, looking across all counties, the death rate is reduced by 0.1 percentage point for each additional five percent of the population that gets vaccinated. Put differently, for every 500 people who get vaccinated, another San Diego life can be saved.

So, even though the regional seven-day average has increased from just two cases per 100,000 residents in June to 38 new cases per 100,000 residents as of August 18, the death rate, at 1.1 percent, remains significantly lower than the U.S. (1.7 percent), California (1.5 percent), and the surrounding counties (1.6 percent to 2.3 percent). Moreover, despite the increase in cases, San Diego’s rate of 38 per 100,000 people still lies below the nation’s 43 case per 100,000 Americans.

The CDC releases county- and state-level COVID caseload forecasts based on models that account for local vaccination rates and assumptions surrounding social distancing, among other items. Similar to California as a whole, San Diego’s relatively high vaccination rate led the CDC to forecast an essentially flat trajectory for cases through mid-September. This is in fairly stark contrast to the projections for U.S. case numbers, which are expected to climb substantially over the next several weeks as unvaccinated populations become susceptible to the profusion of the Delta variant and are exposed to the virus as Main Street businesses reopen.

While another climb in COVID cases is less than ideal, San Diego should be able to emerge from the most recent wave better off than other regions where the local populations are not as widely vaccinated. This should help to mitigate the economic fallout here as residents rebuild the confidence to engage in public life again.

Even so, it is crucial that this analysis not be misconstrued as a reason to let our guard down. If anything, this analysis shows just how critical it is for everyone to get vaccinated to better protect ourselves and our economy. Increased vaccination will help to accelerate the region’s recovery while simultaneously reducing uncertainty around the COVID virus and its variants.