The takeaways

- A solid U.S. jobs report suggests that, in June, San Diego may have recovered as many as 45,000 of the jobs lost to COVID, more than half of which are from leisure/hospitality and retail.

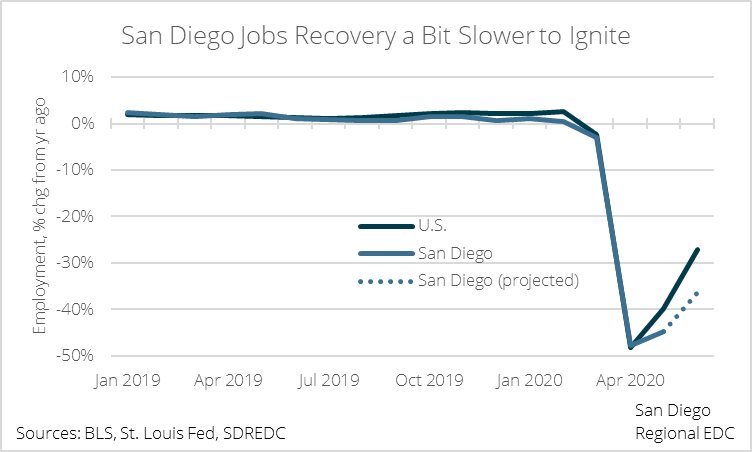

- The San Diego jobs recovery lags the nation’s somewhat as local businesses reopened later than those in other parts of the country.

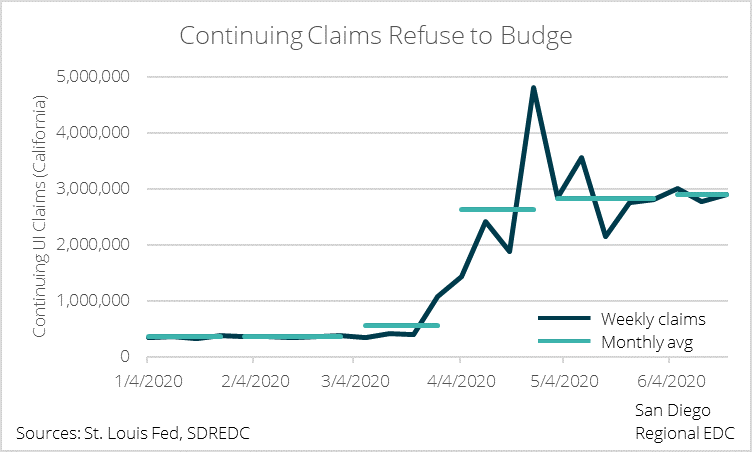

- Persistently high continuing UI claims in California, fresh business closures, and a shift in unemployment from temporary to permanent significantly cloud the near-term outlook.

The Good…

The U.S. job market took another big step forward in June, adding a better than expected 4.8 million payroll jobs. Last month’s report indicates that, in May and June alone, the U.S. recouped roughly 40 percent of the jobs lost to COVID-19. For context, it took the nation 17 months during the Great Recession of 2007 to 2009 to recover 40 percent of the jobs lost during that downturn. In addition, the unemployment rate slid lower to 11.1 percent from 13.3 percent the month prior (although the topline figure alone is misleading—more to follow on that below).

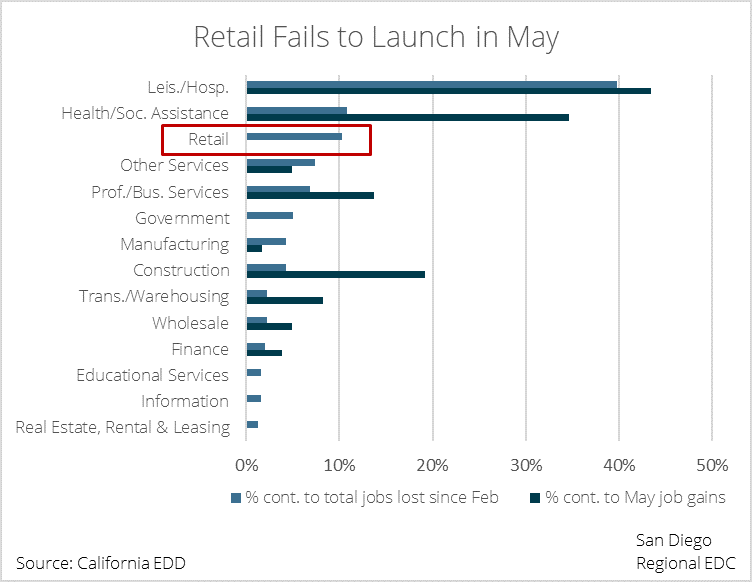

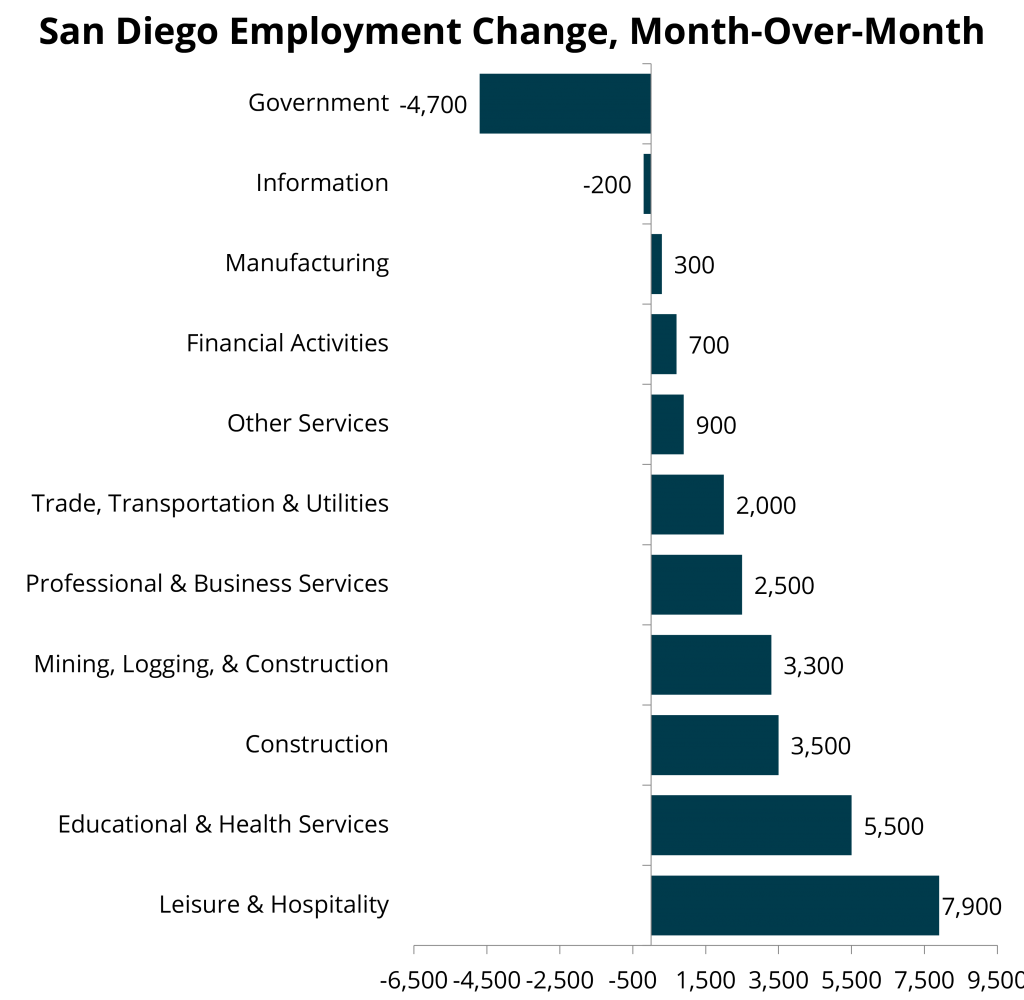

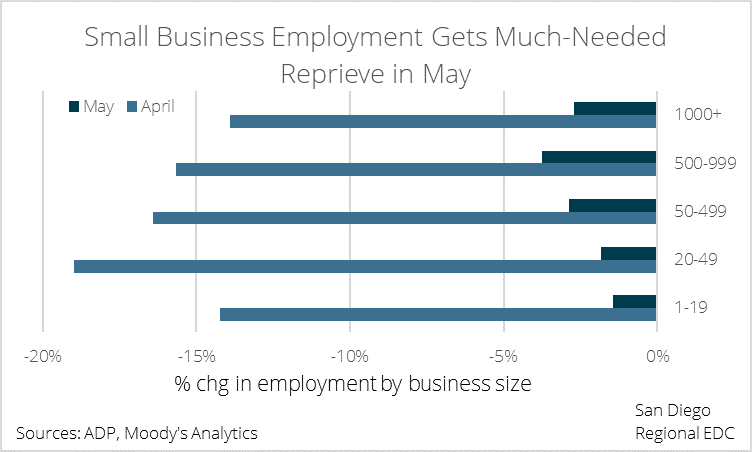

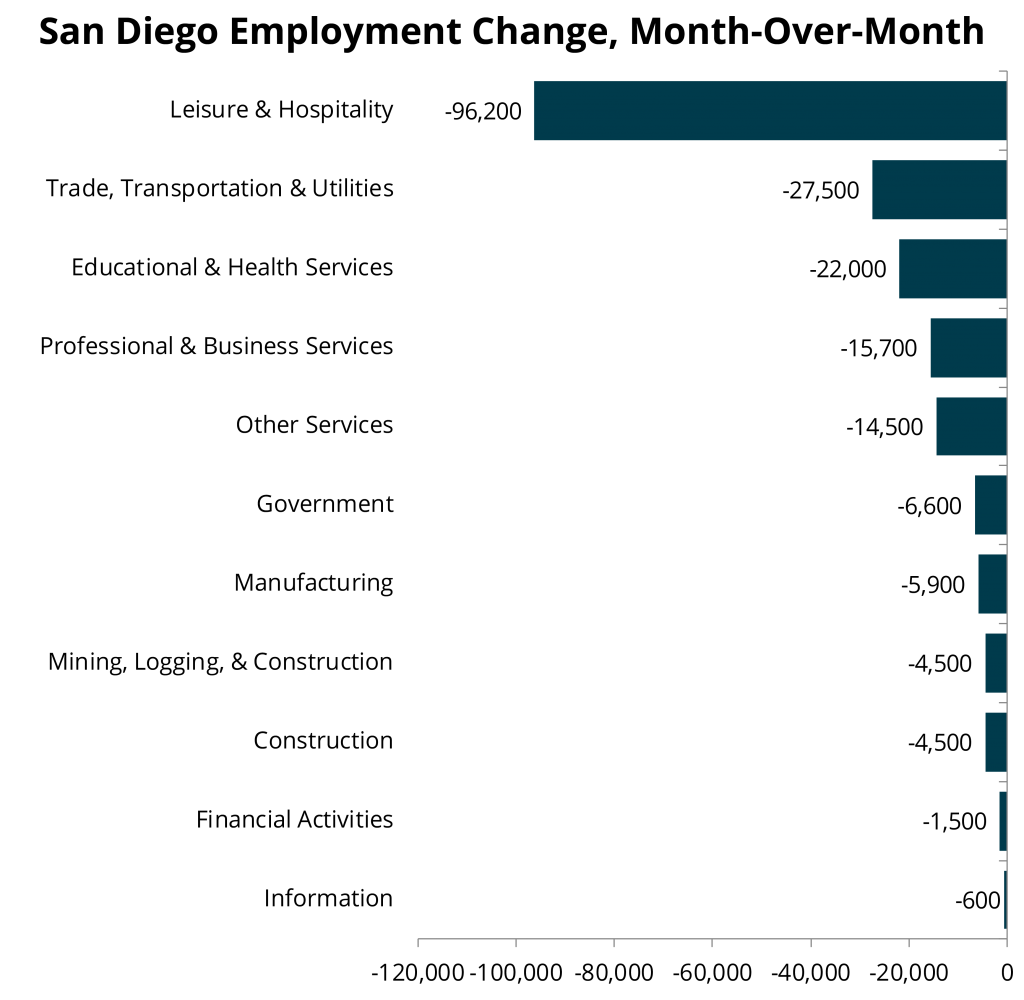

While San Diego’s job market doesn’t necessarily mirror the nation’s, the U.S. employment report can still provide valuable information on what to expect locally in a given month. Looking at the historical relationship for employment in San Diego and the U.S., it’s possible that San Diego may have added back about 45,000 jobs in June, more than half of which could be attributed to leisure/hospitality and retail. Combined with May’s gain of 18,200 jobs, this would mean that roughly 30 to 35 percent of the jobs lost from COVID will have been recovered. The slower pace of recovery compared with the U.S. as a whole can be partly explained by local retailers and restaurants reopening later here than in some other parts of the country.

If history is a guide, then the U.S. job numbers would imply an additional 18,000 to 20,000 leisure/hospitality positions, which would add up to roughly 20 percent of the jobs lost from February to April. In addition, the national figures imply a local recovery of between 7,000 and 8,000 retail positions, or about one in three jobs lost to COVID.

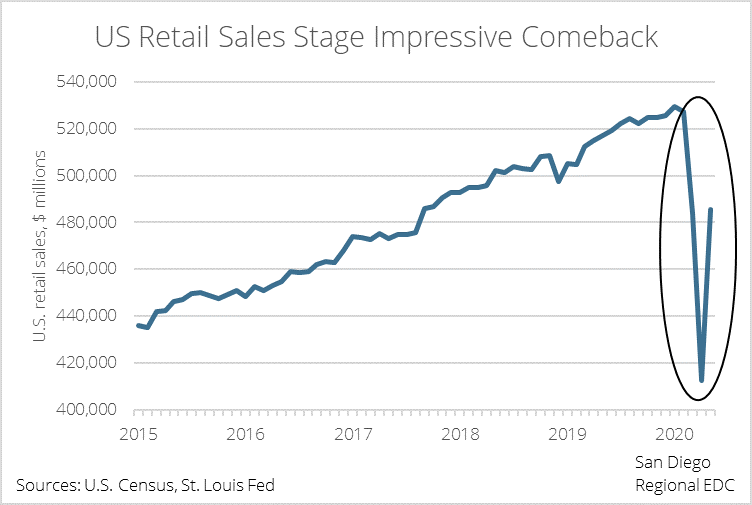

The addition of 7,000 to 8,000 retail jobs in June is slightly higher than our analysis of employment gains due to a rebound in U.S. retail sales that suggested San Diego retailers would add back closer to 6,000 to 6,500 jobs in June. However, the way by which national retail sales figures are averaged would have meant that the number of recovered local jobs could certainly be higher, making the estimate for 7,000 to 8,000 reclaimed positions not implausible.

…The Bad, and the (potentially) ugly

Unfortunately, other data points and recent events significantly cloud the near-term outlook.

Continuing claims for unemployment insurance in California, which are closely correlated to San Diego unemployment, have remained stubbornly high, increasing from an average of 2.83 million in May to 2.89 million in June. On its own, this would suggest a slight increase in the local unemployment rate from 15 percent in May to 15.2 percent in June.

In addition, state, county, and city officials have rolled back reopenings for bars, indoor restaurants, theaters, tasting rooms, and museums until the end of July, which could mean another round of layoffs will show up in the July employment report. The share of people testing positive for COVID-19 has increased from two to three percent for most of May and early June to six to seven percent. Moreover, the number of community outbreaks has reached double-digits in recent weeks, and the county reported more than 1,000 new cases over the Fourth of July weekend alone, prompting the closures.

Finally, despite the drop in the topline U.S. unemployment rate in June, the number of people whose unemployment shifted from temporary to permanent increased by nearly 600,000, bringing the number of permanently laid off workers to a six-year high. If a similar trend takes hold in San Diego, then the jobs recovery could take longer, because permanently laid off workers are more likely to become discouraged, drop out of the labor force, and lose valuable skills, making them significantly less likely to re-enter the job market. As such, it is crucial that these workers have ample access to job training to enhance their skills, keep them engaged, and increase the chances that the coming recovery leads to a more inclusive and resilient San Diego economy going forward.

Taken together, the June employment report—due out July 17—will almost certainly reveal solid monthly job gains. However, other indicators suggest that the labor market is unlikely to enjoy a smooth upward trajectory from here on out. The coming recovery is bound to be rife with bumps, hiccups, twists, and turns this year into next.

For more COVID-19 recovery resources and information, please visit this page.

Regardless of how this all plays out, EDC is here to help. You can use the button below to request our assistance with finding information, applying to relief programs, and more.

You also might like: